approxiamate tax dedecution for mortgage interest

- 01.24.12

- |

- apr card credit low uk

- |

- appy for credit cards apr apr

Mortgage deduction savings sometimes exaggerated

Mar 30, 2009 . Using the "View Report" function on Bankrate's Mortgage tax deduction calculator will show you the approximate interest expense by year on .

http://www.bankrate.com/finance/mortgages/mortgage-deduction-savings-exaggerated.aspx

Causes of the United States housing bubble - Wikipedia, the free ...

Approximate cost to own mortgaged property vs. renting. . The Tax Reform Act of 1986 eliminated the tax deduction for interest paid on credit cards.

http://en.wikipedia.org/wiki/Causes_of_the_United_States_housing_bubble

Free Tax Calculator | Estimate Refund | Paystub Estimator

Easy to use free online calculator for estimating your 1040 Income Tax. . In order to approximate your tax return we will need to just ask you a few simple questions . . You may be able to take total itemized deductions in lieu . •Mortgage Interest . will reimburse you any Federal and/or State penalties and interest charges.

http://www.taxslayer.com/qc/quickcalc.aspx

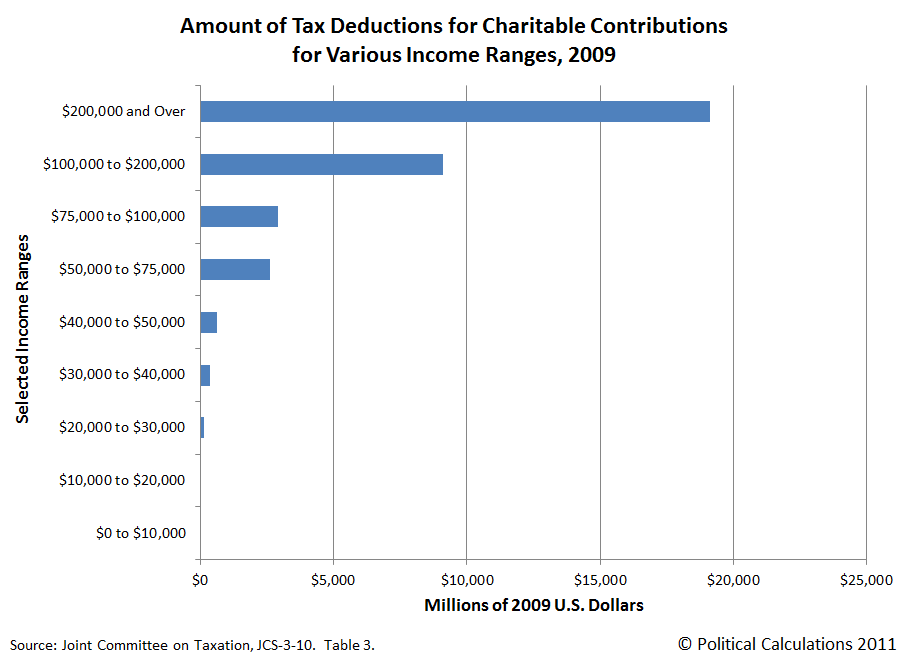

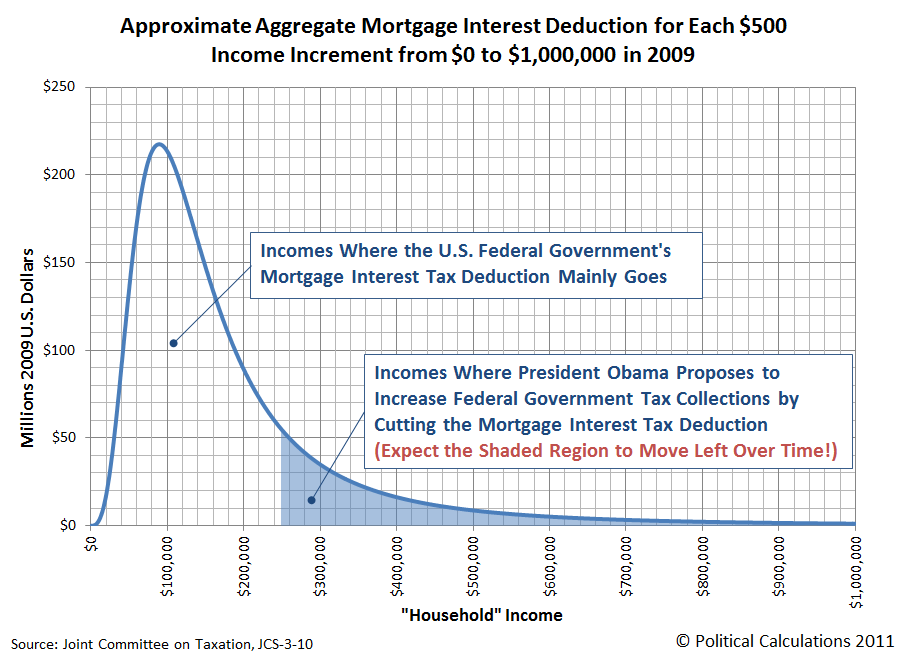

The U.S. Mortgage Interest Deduction by Income Level | MyGovCost ...

Jul 21, 2011 . We then used that data to construct the distribution of the mortgage interest tax deduction by taxpayer household income below: Approximate .

http://www.mygovcost.org/2011/07/21/the-u-s-mortage-interest-deduction-by-income-level/

The Myth of the Tax Deduction | The Simple Dollar

May 11, 2010 . Yes, tax deductions can be useful in some situations. . Ditto to Johanna's comment – the standard deduction is intended to approximate the usual amount one . Your interest deduction on the mortgage should be small.

http://www.thesimpledollar.com/2010/05/11/the-myth-of-the-tax-deduction/

Tax Expenditure of the Week: The Mortgage Interest Deduction

Jan 26, 2011 . The mortgage interest deduction is by far the nation's largest housing program. This tax break, the country's third largest, is expected to provide .

http://www.americanprogress.org/issues/2011/01/te_012611.html

Taking a Rental Property Through an Income & Return Calculation

The Mortgage Interest Deduction on Our Rental Property . without any other deductions any particular owner may bring into play, is our approximate tax liability.

http://realestate.about.com/od/knowthemath/tp/rental-cash.htm

Home Mortgage Interest and Property Tax Deduction

Calculate how mortgage interest and property tax deductions can save you money and make buying a home affordable.

http://www.homebuyergo.com/Mortgage_Interest_Property_Tax_Deduction.aspx

Calculator for true value of mortgage interest write-off ...

That will give you the approximate amount. . Take 1 year of mortgage interest and divide by 3200. . and interest, that is the out of pocket amount, the taxes, insurance and basic maintenance are offset by the tax deduction.

http://piggington.com/calculator_for_true_value_of_mortgage_interest_write_off

Phasing Out Mortgage Interest Deduction Won t Help Anyone - Bank ...

Mar 20, 2012 . But the "tax loophole" is not the mortgage interest deduction, it's the failure to . the approximate value of their lost mortgage interest deduction, .

http://www.americanbanker.com/bankthink/phasing-out-mortgage-interest-deduction-will-not-help-anything-1047684-1.html?zkPrintable=true

Freedom Loan | A1 Mortgage

Won't paying less mortgage interest reduce my tax deduction? . because every $3-$4 in interest you pay the bank you get an approximate $1 tax deduction.

http://www.mya1mortgage.com/freedom-loan

Debt Reduction: Repealing the Home Mortgage Interest Deduction ...

Feb 28, 2011 . If you own a home, you know about the mortgage interest tax deduction. In fact, this has been one of the biggest financial advantages of home .

http://www.savingtoinvest.com/2011/02/debt-reduction-repealing-the-home-mortage-interest-deduction-state-and-local-health-insurance-and-retirement-tax-breaks.html

Frequently Asked Tax Questions

Home Office Deduction Can Save Substantial Taxes . amount so that the net benefit, after taxes, will approximate the moving expenses. . Therefore, the employee is able to claim a corresponding deduction for mortgage interest, and the .

http://www.worldwideerc.org/gov-relations/us-tax-legal-resources/Pages/tax-faq-answers.aspx

Raise Taxes, but Not Tax Rates - NYTimes.com

May 4, 2011 . The deduction for interest on residential mortgages, probably the . adjusted to approximate the total taxes and tax expenditures for 2011.

http://www.nytimes.com/2011/05/05/opinion/05feldstein.html